Adulting with CPF: A Young Singaporean's Guide to Building Your Future

Let's face it—adulting is tough. Between finding your career path, navigating relationships, and attempting to have some kind of social life (on a budget!), the last thing on most young Singaporeans' minds is retirement planning. But here's the reality: your 20s and early 30s are really your financial superpower years, thanks to something magical called compound interest. And at the center of this financial journey stands your CPF—not a compulsory savings plan, but probably your strongest supporter constructing the future you want.

Beyond the Basics: What CPF Really Means for Young Adults

You've probably heard about CPF since your first job, watching that 20% disappear from your hard-earned salary each month (while your employer contributes another 17%). But did you know this seemingly simple system is actually designed to grow with you through different life stages?

Your CPF isn't a single account—it's a whole financial ecosystem with specific purposes:

- Ordinary Account (OA): Your "milestones in life" savings fund. It helps with your first home down payment, insurance premium, and even approved investments. This account earns 2.5% interest annually.

- Special Account (SA): Your long-term retirement workhorse earning a higher 4% interest. This is where consistent early contributions make a massive difference.

- MediSave Account (MA): Your healthcare safety net for medical expenses and insurance premiums, also earning 4% interest.

What most young Singaporeans fail to appreciate is that these accounts are not merely savings containers—they're cleverly crafted financial instruments that, when properly understood and optimized in the early years, can significantly enhance your quality of life at every stage.

Why Most Young Singaporeans Struggle to Save (And How CPF Can Help)

Before diving deeper, let's acknowledge a troubling trend: a staggering 4 out of 5 Singaporean millennials have no personal savings at all, with most of them utterly unconcerned with. This financial procrastination isn't just risky—it's perhaps even life-altering if you consider just how much tougher saving gets as you accumulate more responsibilities.

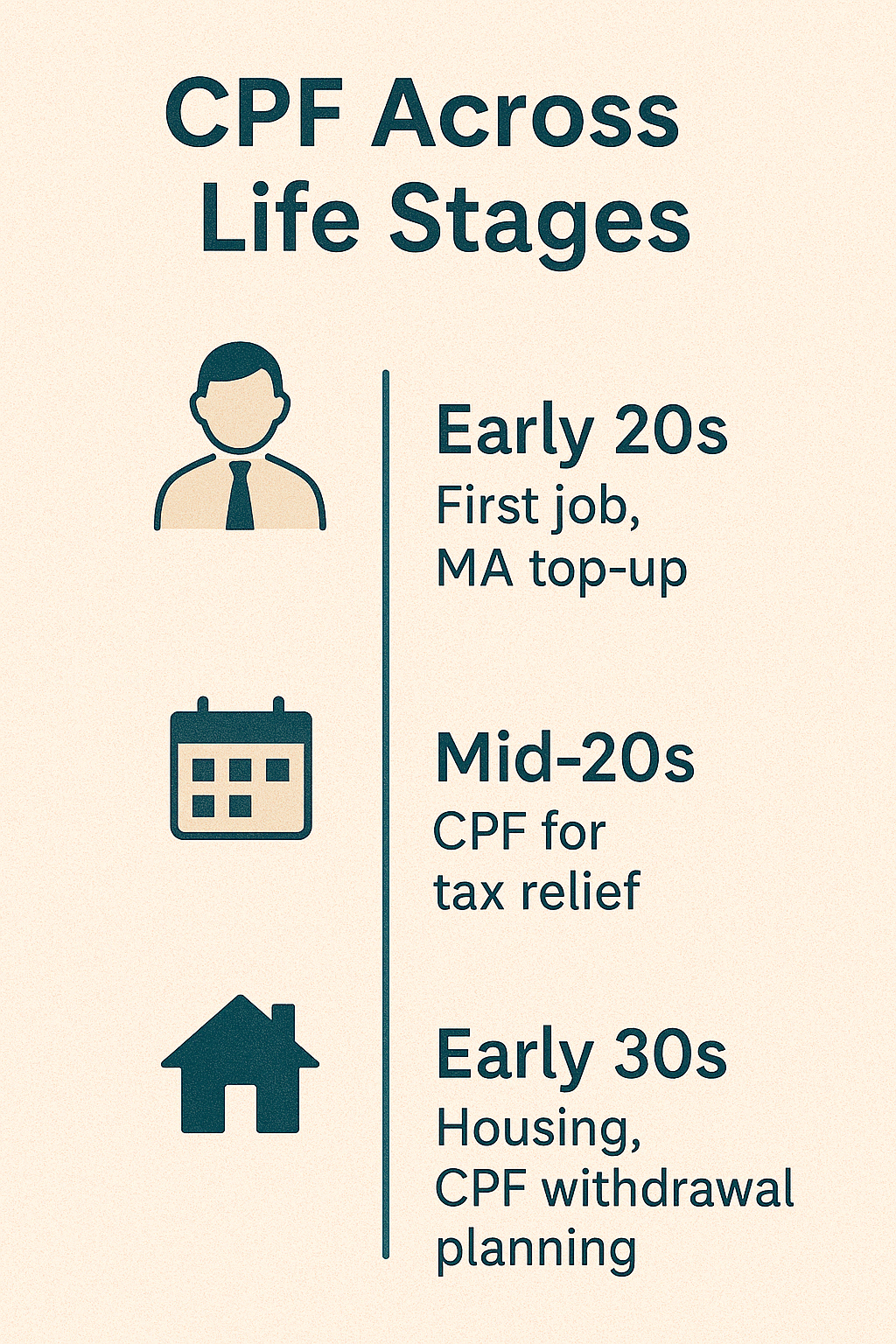

CPF in Your 20s and 30s: How to Maximize Each Life Stage

First Job Stage (Early 20s)

Recall that first salary thrill which all too soon dissolved into "where did all my money go?" Let's go through how your CPF is already benefiting you:

What's happening: Your employer is contributing 17% on top of your salary while 20% comes from you. That can be cash down the drain, but in fact it is your very first serious wealth-building move.

Smart moves to make now:

- Take 15 minutes to set up your CPF online account and actually look at your balances

- Understand your statement—those numbers are real money

- Consider topping up your MA voluntarily if you have recently started working since this can help with healthcare costs while providing good interest returns

Real-life scenario: Min, 25, began her first full-time job at $3,500 a month. Rather than splurging on her very first bonus in entirety, she put in $2,000 into her CPF SA. "It seemed small, but my planner showed me this single payment could grow more than three times to over $10,000 at retirement age due to the 4% interest rate and the power of compounding. That's basically a $8,000 bonus for future-me!"

Career Building Stage (Mid to Late 20s)

With your pay increasing and most likely changed employment a few times, your CPF plan has to change alongside:

What's happening: Your contributions are growing alongside your income. The CPF ceiling for monthly ordinary wages will increase progressively to S$8,000 from January 2026, so more high-income earners will see more going into their CPF.

Smart moves to make now:

- Start thinking about housing—your OA can help fund your first home

- Consider whether it is worth topping up your CPF for your tax situation

- If you are earning enough to be in a higher tax bracket, CPF top-ups of up to $8,000 to your SA can provide you with tax relief

Real-life example: Darren, 28, was promoted that pushed him into a higher tax bracket. "My tax bill was looking scary until I realized I found out that I could save over $1,000 in taxes by topping up my CPF SA by $7,000 that would have been taxed at 11.5%. And now the money is earning 4% instead of sitting idle in my bank account at 0.05%."

Settling Down Stage (Early 30s)

This is when most Singaporeans consider marriage, housing, and possibly starting a family:

What's happening: Your CPF OA really comes in handy when you're looking to purchase your first home. This is when you'll likely make your very first major CPF withdrawal.

Smart moves to make now:

- Calculate how much of your OA you can safely use for housing without affecting retirement sufficiency

- Understand the new CPF housing rules that allow for greater flexibility for buyers to set aside CPF for retirement

- Consider the trade-offs between using more CPF for housing versus keeping it for retirement

Real-life scenario: Sarah and Wei Liang, both 32, were looking to purchase their first HDB flat. "We could have utilised our whole CPF OA for the down payment, but our financial advisor told us that having some money left in OA would allow us to retain a buffer and allow the money to continue growing. We ended up using 70% of our available OA and paying the rest in cash."

Key Decision Points Which All Young Adults Need to Face

"Should I Top Up My CPF or Invest in the Market?"

It is perhaps the most popular conundrum among young adults who are financially-aware. The answer is not one-size-fits-all:

CPF Pros: Guaranteed returns (2.5-4%), tax relief benefit, no effort required

Market Investment Pros: Higher returns potentially, liquidity, asset holding

The reality is that the S&P 500 has averaged around 8% annually over the past 30 years, which mathematically outperforms CPF's guaranteed rates. However, this comes with significantly higher risk and requires investment knowledge.

Strategic strategy: Consider hybrid whereby you:

- Make top-up contributions to CPF to optimize tax relief if you're in a higher tax bracket

- Invest additional savings in diversified market instruments for potential growth

- Recognize that CPF forms your financial safety net, while investments offer growth opportunities

"CPF Top-Up vs. SRS: Where Should My Money Go First?"

For young working professionals with excess savings, this can be a difficult choice:

CPF Special Account top-ups:

- 4% Guaranteed interest

- Tax relief of up to $8,000 for personal top-ups

- Limited withdrawal conditions (generally at retirement age)

- Cannot invest the first $40,000 in your SA

Supplementary Retirement Scheme (SRS):

- Only 0.05% base interest, but you can invest these funds

- Tax relief cap up to $15,300 for Singaporeans

- More flexible withdrawal conditions

- Withdrawal penalty of 5% for early withdrawals

Strategic strategy: If you're just beginning your financial journey and lack any form of investment experience, start with CPF top-ups to receive guaranteed interest while you learn. When you are more comfortable, you can advance to SRS with appropriate investment techniques.

General Misconceptions Concerning CPF for Young People

Myth #1: "CPF is money I'll never see again"

Reality: Though CPF is reserved for future purposes, there are a number of opportunities to draw on it along the way—home purchase, education, hospital bills, and eventually retirement income. Its restrictions actually protect you from impulsive spending, so money will be available when you truly need it.

Myth #2: "I'm too young to worry about retirement"

Reality: The sooner you start, the less your financial decision will cost you. A person who begins to save for retirement at age 25 will have to save far less each month than someone who begins at 35, solely because of interest's power to compound.

Myth #3: "I'll just simply on investments instead of CPF"

Reality: Good financial planning usually involves more than one strategy. CPF gives you a risk-free base on which you can make informed bets with other investments. Think of it as diversification across risk levels.

A Young Adult's CPF Timeline: What to Do When

In Your Early 20s (21-25)

- Familiarize yourself with your CPF accounts and monitor them regularly

- Consider small, regular top-ups to your MA if healthcare is a concern

- Focus on building emergency savings outside CPF

In Your Late 20s (26-30)

- Evaluate whether CPF top-ups make sense for tax relief

- Begin planning for housing needs and understand CPF housing withdrawal rules

- Consider voluntary contributions if you have spare cash earning low interest

In Your Early 30s (31-35)

- Implement a balanced approach between CPF top-ups and other investments

- Plan your housing purchase with CPF OA in mind, but don't deplete it entirely

- Start exploring CPF LIFE options, understanding how early planning affects your eventual monthly payouts

Finding Your CPF Sweet Spot

The most important thing to understand is that CPF isn't a one-size-fits-all system. Your ideal CPF strategy depends on your income level, career stability, family plans, and overall financial goals.

For instance, if you're earning a higher income and facing significant taxes, maximizing your CPF SA top-ups to get the full $8,000 tax relief makes mathematical sense. On the other hand, if you're an entrepreneur with variable income, you might need more liquidity and flexibility with your funds.

The beauty of starting your CPF journey mindfully in your 20s and early 30s is that small adjustments made now can significantly impact your financial freedom later. As one financial planner noted, "The difference between a thoughtful CPF strategy and autopilot mode could easily be hundreds of thousands of dollars by retirement age."

Take Action: Your CPF Next Steps

- Check your current CPF allocation: Log into your CPF account and understand where your monthly contributions are going.

- Run your numbers: Use the CPF calculators available online to see how your savings grow over time and what adjustments might benefit you.

- Consider your next life milestone: Whether it's buying a home, starting a family, or advancing your career, think about how CPF can support this goal.

- Talk to a professional: A financial planner who understands both CPF nuances and your personal goals can help you optimize your strategy.

While financial planning might not be as exciting as planning your next vacation or career move, the peace of mind and options it creates are invaluable. As the CPF Board's campaign aptly puts it: start thinking about #ICanAdult today, because your future self will thank you for it.

Ready to Optimize Your CPF Strategy?

👉 Speak to our financial planning team to get a personalized assessment of your CPF plan and overall financial health. Your journey to financial confidence begins with a single conversation.