CareShield Life for Young Adults: Why Planning Ahead Matters Now

You're young, with career ambitions to fulfill and experiences to be had, so to worry about disabilities is unthinkable—unseemly even. But here is a reality check that puts things into perspective: more than 50% of CareShield Life beneficiaries are aged below 40, and roughly 1 out of every 30 Singaporeans aged 18-49 has some form of disability. These statistics reveal a significant fact: disability cuts across all ages.

What Exactly Is CareShield Life?

CareShield Life is Singapore's national long-term care insurance scheme that is intended to provide basic financial protection if you have serious disability, particularly in old age, when you may be in need of personal and medical care over an extended period of time. It's essentially a financial safety net that kicks in when you need it the most.

For Singaporeans born in 1980 and later, you will automatically be enrolled when you are 30 years old (or from October 1, 2020, whichever is later). If you were born earlier than 1980, you can voluntarily sign up, but those born between 1970 and 1979 who were already insured under ElderShield 400 were automatically enrolled from December 2021 (with an option to opt out by December 31, 2023).

The benefit of CareShield Life is in its long-term care support system. While medical insurance tends to cover sudden healthcare needs, CareShield Life provides ongoing monthly payouts as long as you are severely disabled. At $600 a month in 2020, the payouts increase every year until age 67 or when a successful claim is made, whichever comes first.

The Unexpected Reality of Disability Risk

When we're young, we feel invincible. Disability is something that happens to other people, to older folks or in extraordinary, dramatic situations. Reality is different, though.

According to studies, nearly 1 in 2 healthy Singaporeans aged 65 years old can acquire severe disability during their lifetime. More concerning to young adults, however, is that disability can strike at any age, either due to unforeseen events like accidents, illnesses, or the development of chronic diseases.

Think about it: a sports injury, a road traffic accident, or an unexpected illness can radically change the course of your life. The statistics from the Ministry of Health show that over half of the CareShield Life beneficiaries are less than 40 years old. It is not meant to scare you, but to highlight an essential fact that is often ignored in planning conversations among young adults.

The Financial Advantage of Early Enrollment

One of the best reasons to think about CareShield Life in advance is purely financial. When you're younger and healthier, insurance premiums are generally lower. By enrolling at 30, you lock in lower premium rates compared to signing up later in your life.

Here's a simplified example:

- Adam, Betty, and Carl all enroll in CareShield Life at age 30 in 2020. Adam becomes severely disabled the same year. After just one premium has been paid, he receives paid $600 a month for as long as he remains disabled.

- Betty becomes disabled at age 31 in 2021. She is paid $612 a month for the duration of her disability after two years of premiums.

- Carl remains healthy until retirement age, paying premiums up to age 67. If he is disabled after 2057, he would be getting roughly $1,200 a month—double the initial benefit—due to the raises that are part of the program every year.

This illustrates one of the basic insurance principles: the earlier you start, the more you get covered for what you pay. It's like starting retirement savings in your 20s instead of your 40s—time is literally money.

Beyond Finances: The Peace of Mind Factor

While the financial benefits are clear, there's an intangible yet invaluable benefit to early enrollment: peace of mind.

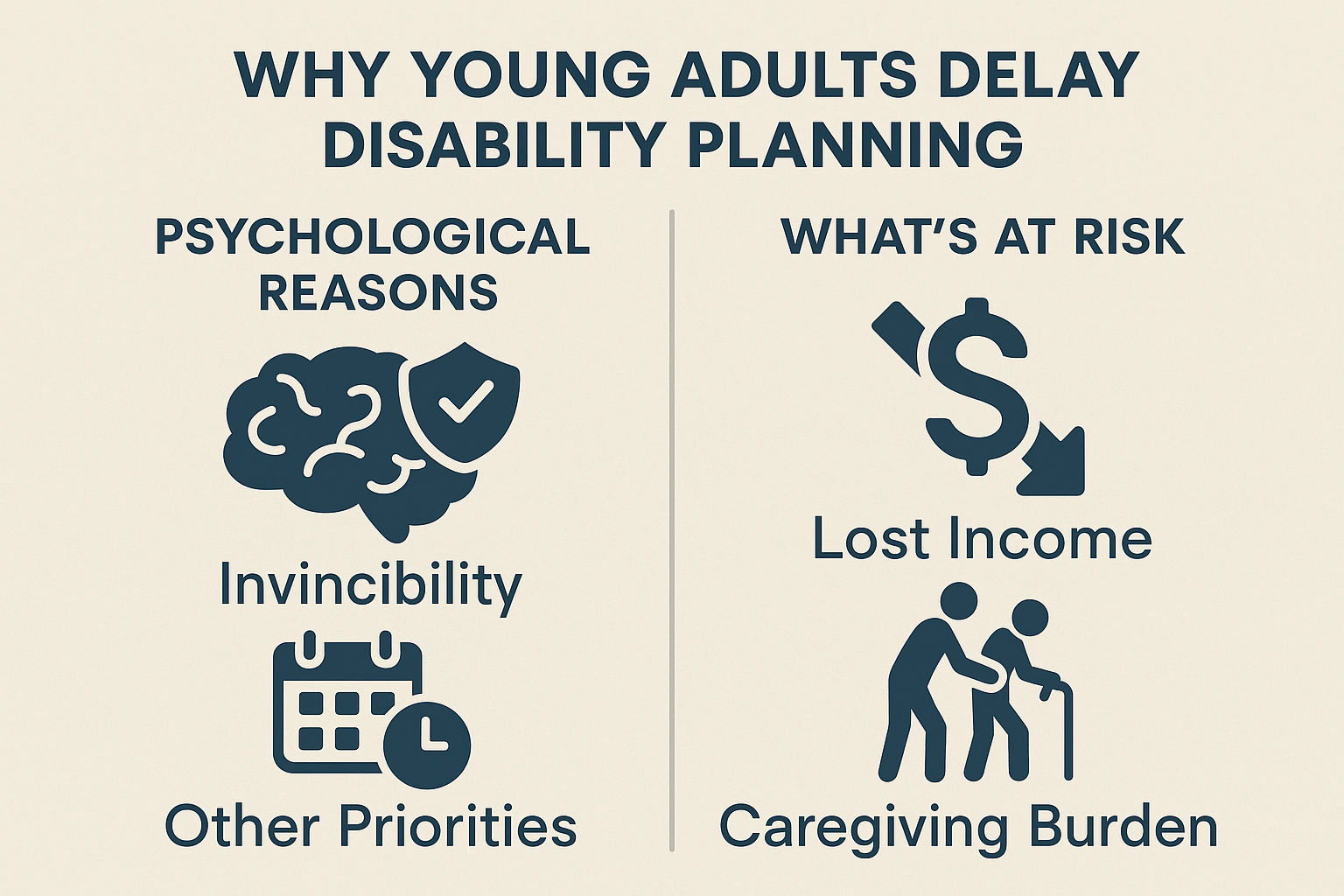

When you're young, you typically have fewer savings to cushion against loss of income. You're also likely at a stage of life with significant financial commitments—perhaps paying off education loans, saving for a home, or starting a family. A disability during this phase could be financially devastating without proper protection.

Having CareShield Life coverage means that you can be sure that if disability strikes, you'll have a consistent monthly income to help with:

- Daily living expenses

- Caregiving costs

- Medical equipment and supplies

- Home modifications

- Rehabilitation therapies

This financial support allows you to focus on recovery and adaptation rather than worrying about how to make ends meet. It protects not just you, but also prevents your disability from becoming a financial burden on your loved ones.

Incorporating CareShield Life into Your Overall Financial Planning

As a young adult, where does CareShield Life leave you in terms of your overall financial plan?

The Foundation of Your Insurance Portfolio

Think CareShield Life as being one integral element of an entire insurance portfolio. Although it safeguards against severe disability, you ought to also factor in:

- Health insurance (such as an Integrated Shield Plan) for hospitalization and medical costs

- Critical illness coverage for major diseases

- Life insurance if you have dependents

A survey in 2023 indicated that over 68% of Gen Z respondents lack coverage for critical illnesses such as cancer and stroke. The lack of such coverage mirrors the general trend of underinsurance among young adults, who prefer short-term experience to long-term financial planning.

Enhancing Your Coverage

While CareShield Life provides basic protection, you might want to consider supplementary plans for more comprehensive coverage. For example, Care Secure offers:

- Enhanced monthly disability benefits of up to $5,000

- Additional support benefits to help with recovery

- Dependant benefits if you have family members relying on you

- Death benefits in certain circumstances

These supplements can be paid for using MediSave funds (up to $600 per year), making them an affordable way to boost your protection.

Starting Your CareShield Life Journey

If you are a Singaporean born from 1980 onwards, you will be automatically enrolled in CareShield Life when you turn 30. You'll receive a letter about two months before your 30th birthday with information about your personalized premiums.

If you're turning 30 or just reaching 30, here's what you should do:

- Understand your coverage: Familiarize yourself with exactly what CareShield Life covers and how it works.

- Review your premium amount: Your premium will depend on various factors, including your age, gender, and whether you're a Singapore Citizen or Permanent Resident.

- Consider your needs: Assess whether the basic CareShield Life coverage is sufficient for your lifestyle and financial commitments.

- Explore supplements: If you realize that you require more coverage, look into supplementary plans like Care Secure.

- Integrate with your financial plan: Work with a financial advisor to see how CareShield Life fits into your overall insurance and savings strategy.

Why Young Adults Often Overlook Disability Coverage

Despite the clear benefits, many young adults still don't prioritize disability insurance. There are several reasons for this:

The Invincibility Illusion

When you're young and healthy, it's difficult to imagine becoming disabled. This psychological distance makes it easy to postpone thinking about disability coverage.

Competing Financial Priorities

From building emergency funds to saving for a home or investing for retirement, young adults juggle numerous financial goals. Disability insurance can seem less urgent compared to these immediate needs.

The "Live in the Moment" Mindset

Many young adults, particularly Gen Z, embrace a "live in the moment" philosophy, prioritizing experiences over long-term planning. While enjoying life's pleasures is important, finding a balance with future security is equally essential.

Lack of Awareness

Simply put, many young adults don't know enough about disability insurance or understand its importance. Education on this topic is often minimal compared to other financial subjects.

The Reality Check: Why Acting Now Matters

While these reasons for delay are understandable, they don't change the underlying reality: disability can strike anyone, at any time.

Consider this perspective: the earlier disability strikes, the more years you could live with it—and the higher the cost could be to the rest of your life. Early enrollment ensures you're covered through those vulnerable decades.

Moreover, registering early guarantees that you have lesser opportunities of possessing pre-existing medical conditions that could compromise your admissibility for add-on coverage. It's similar to buying health insurance before you get sick—once a condition develops, it becomes more difficult and expensive to get coverage.

A Small Decision Today for Major Protection Tomorrow

CareShield Life is one of those rare financial decisions where it makes sense to do so early, with certain, tangible benefits and very few negatives. By taking up your automatic enrollment at age 30 (or enrolling if you are eligible but not automatically enrolled), you're making a wise choice that protects your financial future from one of life's greatest dangers.

Remember that 1 out of 2 healthy Singaporeans at the age of 65 could develop severe disability in their lifetime. Planning for this possibility isn't pessimistic—it is practical. Just as you would never drive with car insurance or live in a house without fire insurance, you would never live life without disability insurance.

Take the time today to understand your CareShield Life coverage, consider whether additional coverage is appropriate for your situation, and integrate this protection into your broader financial plan. Your future self—whether health problems do or do not occur—will thank you.

In a world where so little is known, taking hold of what you can is empowering. CareShield Life gives you the ability to do that, providing a foundation of financial security that will be there for you across your lifespan, whatever lies ahead.

Need Help With Your Insurance Planning?

👉 Speak to our financial planning team to find out more about CareShield Life and how it fits into your overall financial strategy →