How to Integrate CareShield Life with Private Disability Insurance for Comprehensive Coverage

When it comes to financial planning in Singapore, disability protection is essential, but it’s something many people tend to forget about. Given that nearly half of all healthy Singaporeans who reach age 65 may develop a severe disability at some point, having enough coverage isn’t just wise—it is crucial for your long-term financial security. CareShield Life, the government’s basic safety net, offers a starting point. However, for many professionals, it is simply not enough to safeguard their lifestyle should disability ever come into play. In this guide, we’ll walk you through how to combine CareShield Life with private disability insurance so you can get the best possible protection.

Getting to Know CareShield Life: Your First Line of Defense Against Disability

CareShield Life is Singapore’s national long-term care insurance, set up to give you some financial help if you become severely disabled, particularly as you get older. Introduced in 2020, it took over from the old ElderShield scheme and offers better benefits as well as wider coverage.

So, who actually gets covered by CareShield Life?

- If you were born in 1980 or after, you’re automatically covered by CareShield Life either starting October 1, 2020, or when you turn 30, whichever comes later.

- If you were born in 1979 or earlier, joining is optional. If you were born between 1970 and 1979, had ElderShield 400 coverage, and weren’t severely disabled, you were automatically signed up, although you could choose to opt out any time before December 31, 2023.

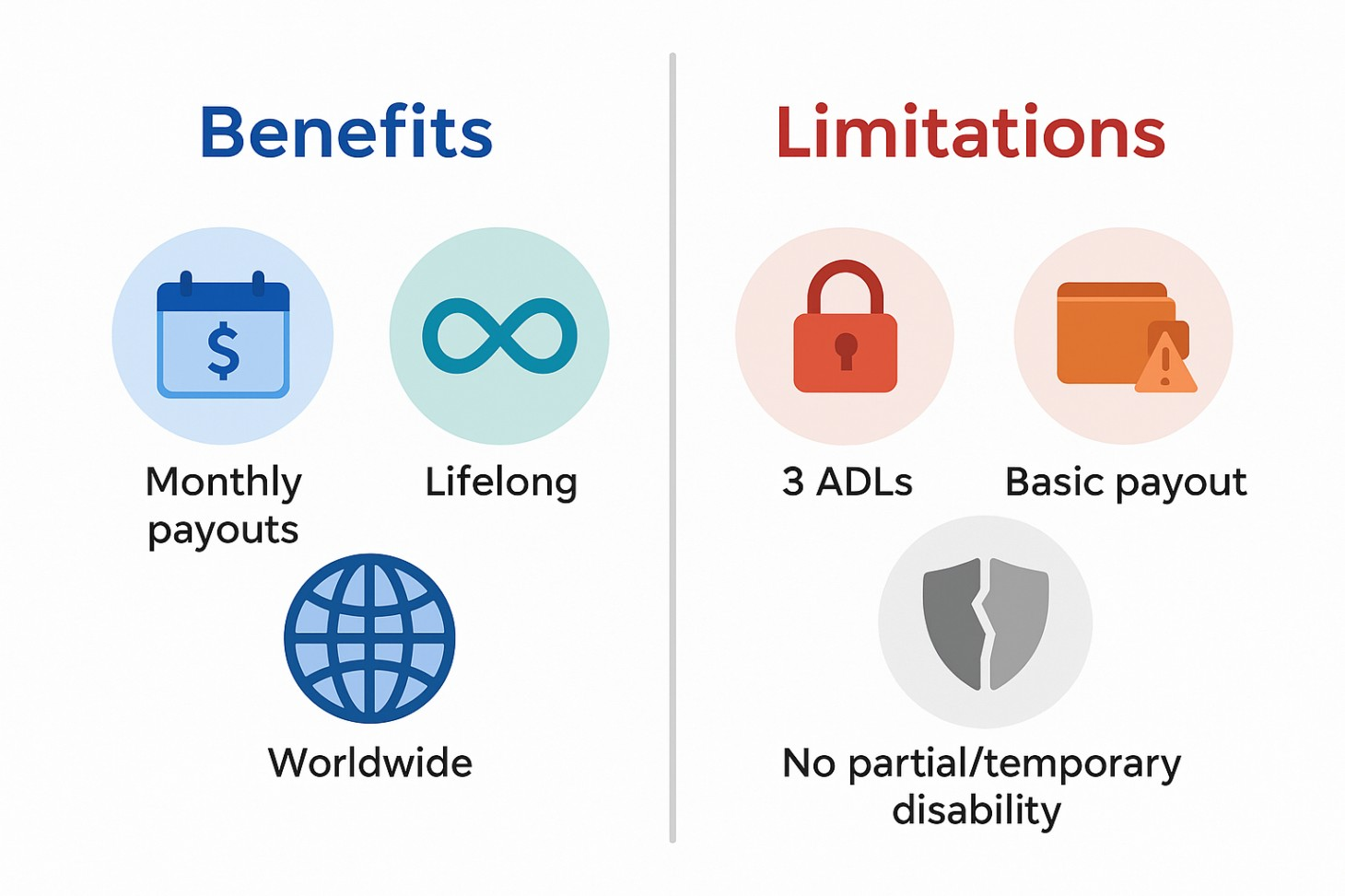

What CareShield Life Does Well and Where It Falls Short

If you ever become severely disabled, meaning you can’t manage at least three out of six basic daily tasks like washing, using the toilet, eating, getting dressed, moving from place to place, or getting around, CareShield Life will pay you a monthly benefit for as long as you need it.

Here’s what you stand to gain:

- Starting in 2025, you’ll receive monthly payouts of $662.

- You’ll keep receiving payouts for as long as your severe disability lasts.

- The payout amount goes up every year until you turn 67, or until you make a claim, whichever happens first.

- Worldwide coverage

Where CareShield Life Falls Short:

- You’ll only qualify for payouts if you’re unable to do at least three basic daily activities.

- For many professionals, the basic payout simply doesn’t stretch far enough.

- Partial or temporary disabilities are not covered.

What Kinds of Private Disability Insurance Can You Get in Singapore?

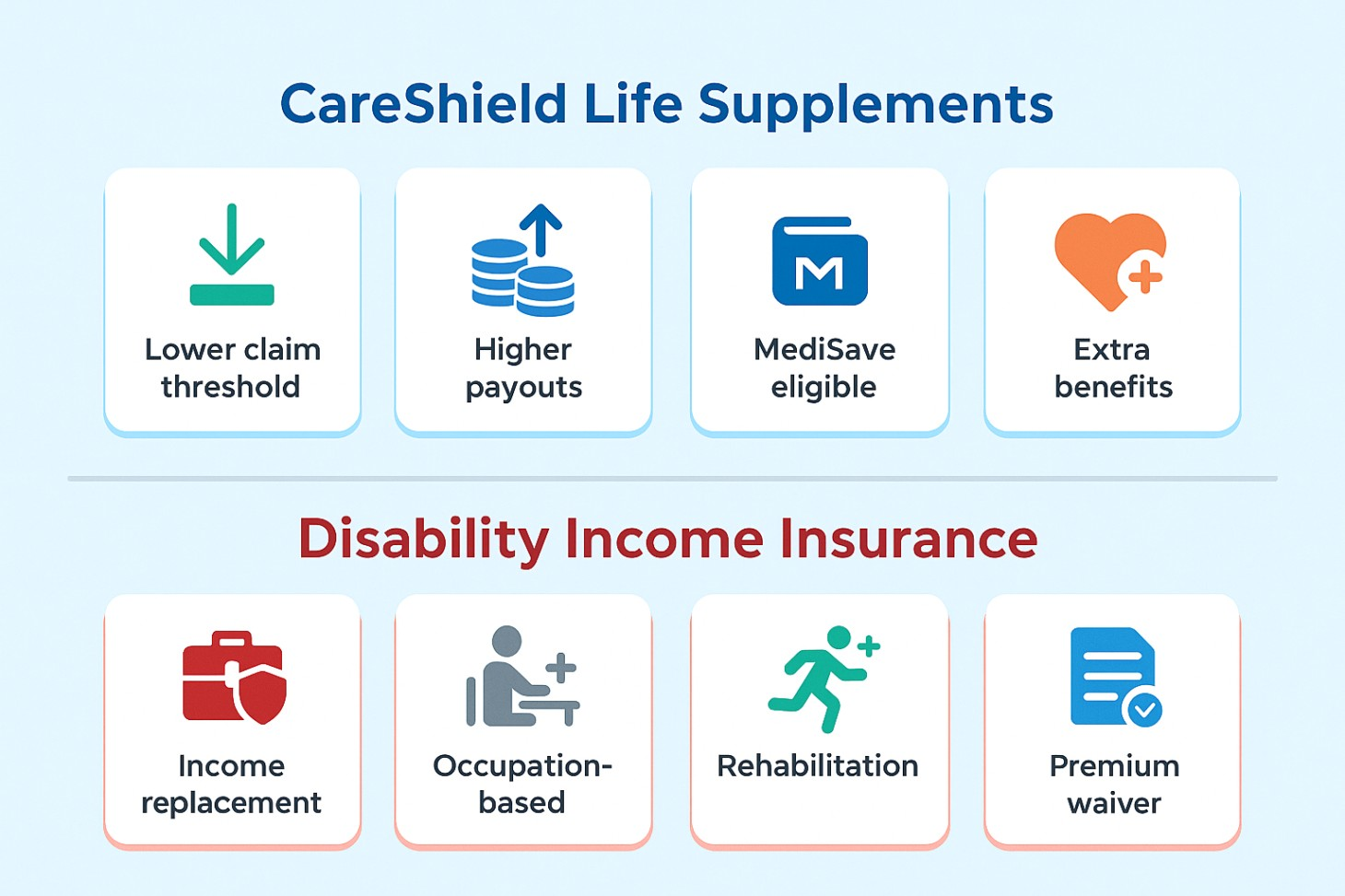

Boosting Your Coverage with CareShield Life Supplements

Three private insurers (Singlife, Great Eastern, and Income Insurance) offer CareShield Life supplements. These plans give you extra monthly disability payouts, in addition to what you already receive from CareShield Life.

- Easier to claim: With certain supplements, you can start receiving payouts if you struggle with just one or two daily living activities, unlike CareShield Life, which pays only when you can’t manage at least three.

- Higher payout amounts: Depending on the plan and insurer, supplements can boost your monthly benefit to as much as $5,000.

- MediSave-eligible premiums: You can tap into your MediSave to cover up to $600 a year for these supplement premiums.

- Extra perks: Many supplement plans include benefits like one-time payouts, rehabilitation support, premium waivers, and even caregiver support.

Disability Income Insurance: Safeguarding Your Paycheck

- You could receive monthly payments that replace up to 75% of your pre-disability income.

- Occupation-based assessment: These plans usually assess whether you can continue working in your specific job, rather than focusing on daily living tasks.

- Rehabilitation and support: Many plans offer rehabilitation support and may include payouts for catastrophic disability or provide a lump sum in extreme cases.

- Premium waiver: Premium payments are usually waived while you’re receiving benefits.

How to Combine CareShield Life with Private Disability Insurance

Figuring Out How Much Disability Coverage You Really Need

- Monthly expenses and financial commitments: Assess how much money you’d need each month to maintain your lifestyle and cover mortgage payments, loans, and dependent care.

- Identify coverage gaps: Look at where CareShield Life might fall short, such as lack of protection for partial disabilities or job-specific needs.

- Consider life stage and career path: Your needs will change as you age, progress in your career, or take on new family responsibilities.

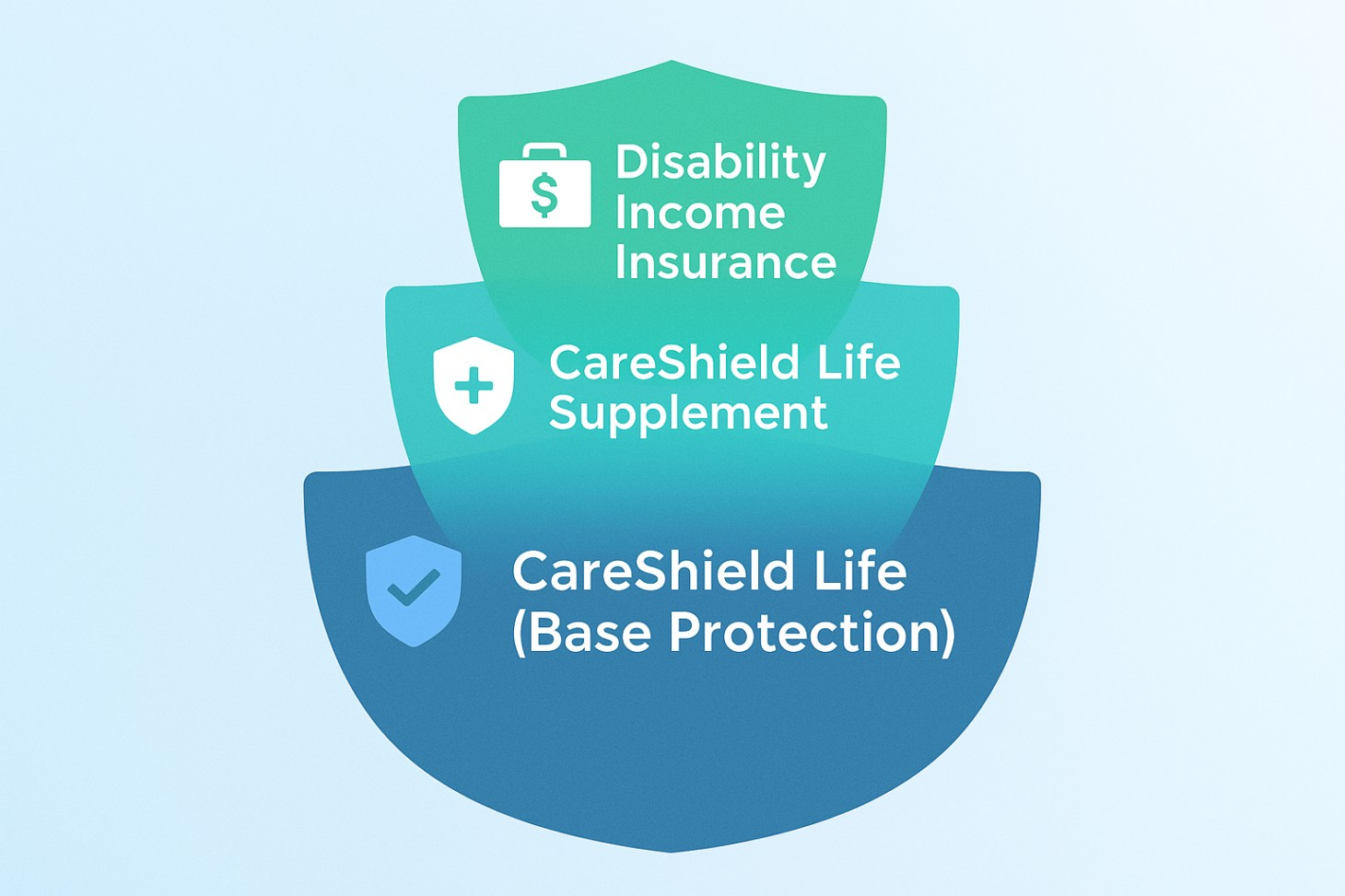

Building Disability Coverage in Layers

- Start with the basics: CareShield Life as your foundation. Think of this as your safety net. It provides lifelong protection if you ever suffer a severe disability.

- Next, add a CareShield Life Supplement. Supplements help you:

- Qualify for benefits more easily

- Receive higher monthly payouts

- Access additional benefits like rehab support

- Add disability income insurance to complete your plan. For working professionals, particularly those with higher incomes, disability income insurance helps:

- Cover lost income if you can’t work in your current occupation

- Protect more of your income

- Offer protection against temporary disability

Real-Life Examples: How to Combine These Plans for Better Coverage

Case Study 1: A Young Professional Earning a High Income

- A 35-year-old IT professional

- Monthly income of $10,000

- CareShield Life + Singlife CareShield Plus ($3,000/month) + AIA Disability Income ($5,000/month)

Case Study 2: A Mid-Career Professional Supporting a Family

- A 45-year-old mid-level manager

- Sole breadwinner for a family

- CareShield Life + Great CareShield + short-term disability income coverage

Cost Optimization Strategies

- Leverage MediSave to pay for premiums

- Tap into family members’ MediSave accounts

- Use premium subsidies (up to 30%) and participation incentives

- Buy early to lock in lower premiums

- Choose longer deferment periods to reduce costs

- Avoid duplicate coverage

Common Questions About Combining Disability Insurance

- If I move from ElderShield to CareShield Life, will my supplement still be valid?

Yes, as long as you keep paying your premiums and remain covered under CareShield Life or ElderShield. - Can I make claims from both CareShield Life and my private disability insurance at the same time?

Yes, you can claim from both policies as long as you meet the requirements for each. - What makes CareShield Life supplements from different insurers different?

Definitions of disability, premium terms, additional features, and promotional offers vary by insurer. - Should I cancel my ElderShield if I already have private disability income insurance?

No. ElderShield or CareShield Life covers long-term care, while disability income insurance replaces income.

Wrapping Up: How to Build a Disability Protection Plan That Truly Covers You

Blending CareShield Life with private disability insurance shouldn’t be rushed. It’s important to carefully consider your financial situation, personal needs, and long-term goals before making a decision. The key is to protect yourself against various disability risks without overpaying for premiums.

Remember, your need for disability protection will evolve over time. Regularly review your coverage to ensure it still matches your life circumstances. Speaking with a knowledgeable financial advisor can help you design a plan that offers the protection you need without unnecessary costs.

By thoughtfully layering your disability protection—starting with the foundational coverage of CareShield Life, enhancing it with supplements, and completing it with income replacement through private insurance—you can build a strong safety net that protects both you and your family from the financial impact of disability at every stage of life.

Need Help Combining CareShield Life with Private Insurance?

👉 Schedule a 1-on-1 consultation with our advisory team to build a disability plan tailored to your life and career path →